Investment trends

How Do Art Returns Compare to the S&P?

See Also: ArtlinkGlobal Auction News Advisories at:

http://artlinkglobaladvisory.wordpress.com/

See Also: ArtlinkGlobal Benchmarks for Designers at:

http://www.houzz.com/ideabooks/22926344

By Ed McCarthy, CFP

April 14, 2013

Art-auction headlines tend to reflect sales prices and trends among the highest-valued artworks.

These multimillion-dollar transactions, though, don’t always reflect what’s really happening with overall art prices or prices for specific fine-art markets.

For example, if a painting sold at auction in 1995 and didn’t change hands again until 2012, Mei Moses would add the object and the two prices to its database in 2012.

That information allows the firm to calculate a compound average rate of return for this particular piece for the period between transactions. The firm says this approach allowed the firm to add almost 3,100 objects to its database last year.

The results can be surprising–as shown by a major-piece example highlighted in the firm’s recent analysis of 2012’s sales.

Picasso’s Nature Morte Aux Tulipes sold for $41.5 million in November 2012. The previous transaction price was $28.6 million in 2000, which Mei Moses calculates produced a 3.0% compound annual return for the seller.

“This painting was bought at a major peak in the art market for a significant price and thus the modest return is not a surprise… It is also true that the owner had the opportunity of enjoying this painting and would not have been better served by investing in the S&P total return index, except for transaction costs, for the same period of time,” according to the firm.

The roughly 3,100 sale-pairs Mei Moses identified in 2012 generated an average compound annual return of 6.7% versus 6.8% for the S&P 500 total return index for the same holding periods.

“This is a positive result for the owners of the art since they achieved relatively similar returns, before transaction costs, and obtained the enjoyment from viewing the art for free or at the cost of the transaction,” the Mei Moses report concludes.

Sales of post-war and contemporary art, especially of safe, blue chip artists

such as the $75m Rothko sold at Sotheby’s in November 2012,

helped put the US back on top as the world’s art market leader

US retakes top spot in art sales from China in 2012

The economist Clare McAndrew

releases her annual global art market report

at Tefaf Maastricht

By Clare McAndrew

Published online:in The Art Newspaper on 14 March 2013

Sales of post-war and contemporary art, especially of safe, blue chip artists such as the $75m Rothko sold at Sotheby’s in November 2012, helped put theUS back on top as the world’s art market leader

On Friday, 15 March, the art economist Clare McAndrew presented the findings of her annual art market report at a panel discussion held during Tefaf in Maastricht. Focusing on the emerging market of China and Brazil, the report reveals a shuffle in countries leading the market, with the US regaining the top position above China. It takes the temperature of the international art economy, which McAndrew finds to be resilient but closely tied to wider financial events.

While art has shown relative resilience to the recent global financial crises compared to other asset markets, its fate as a whole is increasingly tied to wider economic events, in particular the expansion and distribution of global wealth. Poor and variable economic growth along with political uncertainties encouraged investors to retreat to the safest and most low-risk areas of many asset markets over the past year, such as bonds and blue-chip stocks. In the art market, this was exemplified by cautious buying and selling in many areas leading to a strong polarization of the market, with the best performance seen at the top end of the best quality works and the most well known artists.

Last year was fraught with economic worries in many parts of the world, and this filtered down to parts of the art market. In 2012, global sales of fine and decorative art and antiques contracted by 7% in value, reaching €43bn. This contraction eliminated the gains recovered over 2011, but this was still a less dramatic change than the previous boom and bust years. This is due to the fact that many sectors have been recovering at different rates. Unlike the boom years from 2005 to 2007, when nearly everything did well, or the two that followed, when virtually nothing did, the past two years have seen mixed fortunes for different countries, sectors and individual businesses, leading to more stability in overall sales figures. This has protected the market’s downside risk, reducing the possibility of more extreme and protracted booms or busts.

The fine art sector has dominated growth and it continues to be where many record prices are achieved. Post-war and contemporary art had the strongest sales, with a 43% share of the fine art market’s value. Within this sector, the “flight to safety” among art buyers was obvious, with the heaviest buying concentrated on well-established artists who have a proven track record achieving the highest prices. Auction houses have been successful in securing some of the best works for sale for the small number of blue-chip contemporary artists, which has forced some dealers to start looking at a wider range of artists, including new or “higher risk” artists in the primary market.

Different national markets have also shown mixed performances. The rise in sales during 2011 was buoyed in part by Chinese auction houses, however after two years of exceptional increases, growth slowed significantly last year. The value of sales in the Chinese market decreased by 24% to €10.6bn as demand cooled and lower priced works of a lesser quality came on to the market. However, counterbalancing this sharp decline to some degree, sales in the US experienced an uplift of 5% over the past year, reaching a high of €14.3bn.

Most European markets performed poorly in 2012. Sales were virtually stagnant in the UK, while nearly all the other large markets such as France, Germany and Italy experienced declines, and overall sales in the EU down by 3%. This result is in part due to the fact that most sales in Europe are for middle to lower priced art, which has shown the most weakness in the market. The continuing economic problems in the Eurozone, which slipped back into recession in 2012 after two years of low growth, have also led to declining consumer confidence and a cautious investment climate in many markets, including art.

http://www.artmarket.com/trends-2011.html

Artprice’s annual art market report 2011

A R E C O R D Y E A R I N 2011

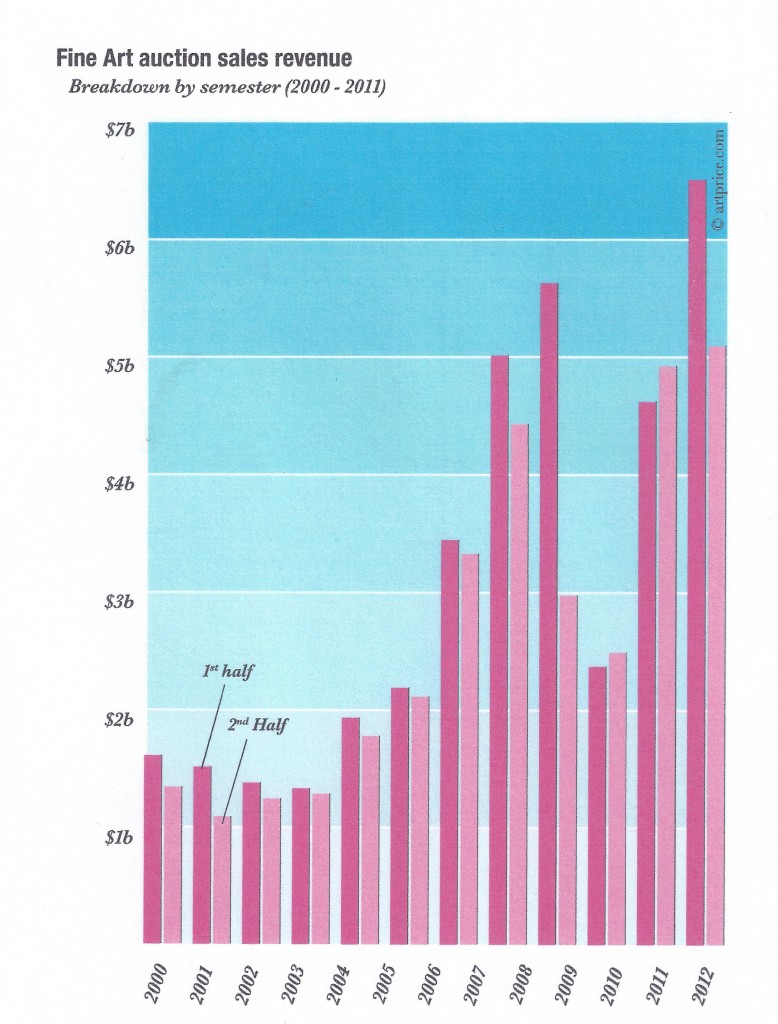

In spite of the sword of Damocles hanging over the West, art in fact sold better in 2011 than at any other time in history with $11.57 billion in total global annual revenue, up $2 billion versus 2010, which already produced the best performance of the decade. This increase was not solely generated by the Chinese market’s 49% growth compared with 2010; it represented overall growth… including European. Indeed, the leading European auction markets posted strong figures:

+24% in the UK ($2.24 billion in 2011 vs. $1.81 billion in 2010),

+9% in France ($521 million vs. $478 million in 2010)

+23% in Germany($213.9 million vs. $174 in 2010).

In the top 5 market places, only the USA contracted with a revenue total of $2.72B, down 3% vs. 2010.

In 2011, the high-end market displayed an extraordinary dynamism. No fewer than 1,675 artworks sold above the $1 million threshold (including 59 above the $10 million threshold) representing a 32% increase of 7-figure (or more) auction sales versus 2010 and an increase of 493% versus the start of the decade! And it comes as no surprise that China posted by far the best national score with 774. Indeed, Hong Kong posted twice as many million-plus results as the entire Euro area!

Further evidence of this exceptional health: the year saw no less than 12,400 new auction records for artists (excluding auctions debuts). See www.Artprice.com

- Economist and Art Historian:

- Proprietary search, authentication and strategic implementation at auctions worldwide